The Chinese Stimulus Bomb

Whether the stimulus will be enough remains to be seen. However, China’s move has the marginal effect of increasing global liquidity, which has historically been a great catalyst for Bitcoin.

China today unveiled a series of economic measures that represent the largest economic stimulus package since the Covid pandemic. Key highlights include:

A 0.5% cut in the Reserve Requirement Ratio (RRR) for banks, reducing it to 0.50. This move will free up approximately 1 trillion yuan (US$142.21 billion or R$782 billion) for new loans.

New guidelines for tariff reductions and targeted support for the real estate sector.

Between 2003 and 2019, China experienced a major boom in its real estate market. However, recent years have seen a major slowdown. One of the peaks of this decline was Evergrande—China’s largest real estate developer—which was forced to close its doors in January 2024.

China is aggressively cutting interest rates to try to limit the slowdown. But there’s a catch: Chinese 10-year interest rates have just fallen below 2%. The interest rate cut doesn’t seem to be enough to restore the deleveraged real estate market.

Between 2003 and 2019, China experienced a major housing boom. However, recent years have seen a major slowdown. It’s important to note that Chinese households hold 60%+ of their wealth in Chinese properties. The House Price Index for Chinese tier-1 cities continues to hit new lows, approaching levels not seen in 8 years.

Whether the stimulus will be enough remains to be seen. However, China’s move has the marginal effect of increasing global liquidity, which has historically been a great catalyst for Bitcoin.

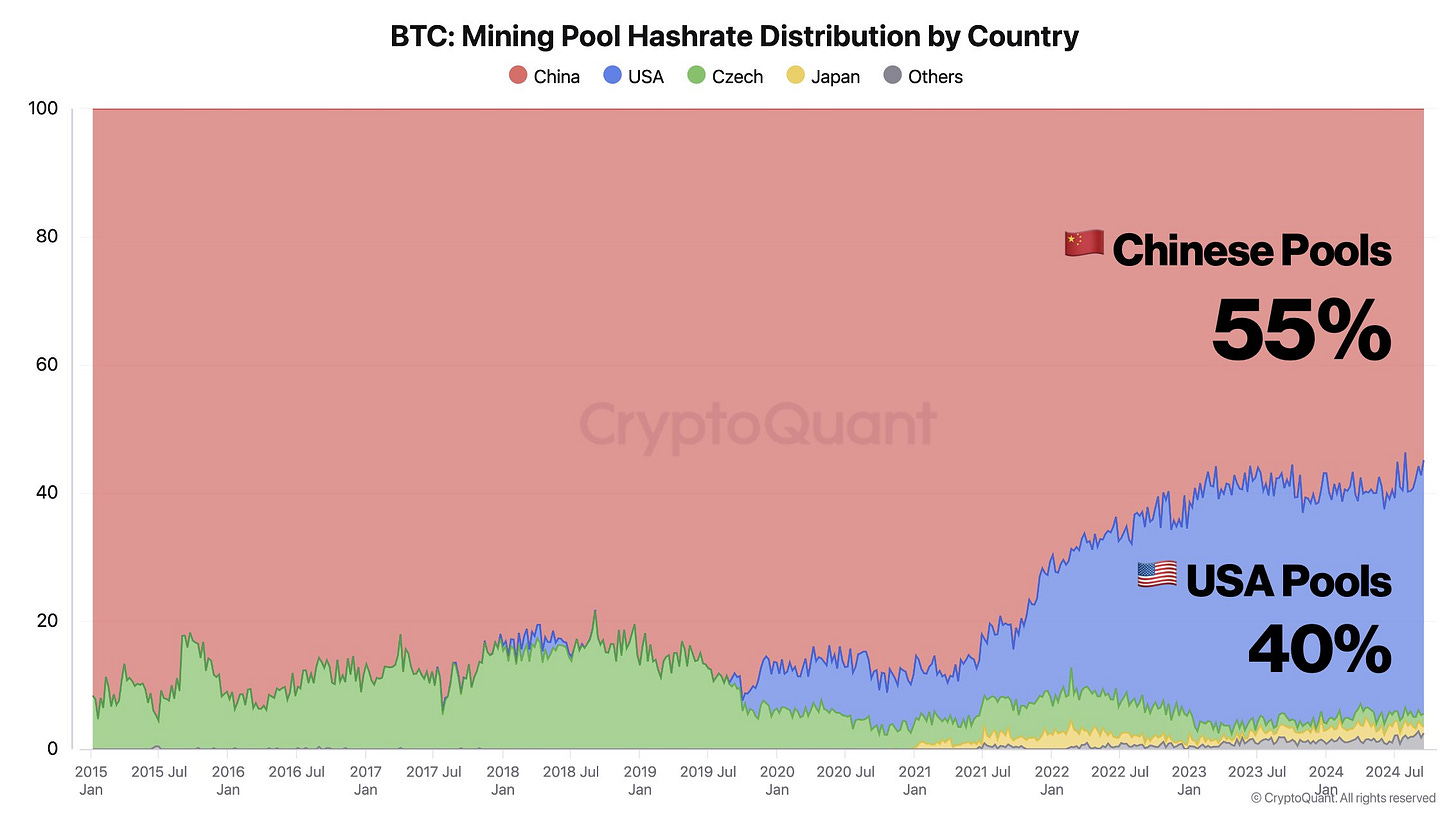

Interesting and strange fact: despite China banning Bitcoin-related activities a few years ago, recent studies show that the country still accounts for 55% of Bitcoin’s hashrate.

It is curious how the measures taken by countries that are officially against Bitcoin continue to highlight the need for the asset and, often, can even boost its price.